Profitunity Analysis of Bitcoin Futures and The Elliott Wave Count – PART 3 FOLLOW UP

The current count on Bitcoin is showing that we have finished the corrective wave marked as 5/C on the chart. Looking at the behavior since

We will support you with books, videos and graphic materials.

Private tutoring that will guide in all moment through the process.

You will apply the learning process on real live trading.

Choose the package that suits you better or contact us for more

support information to help you select what you need in every

moment.

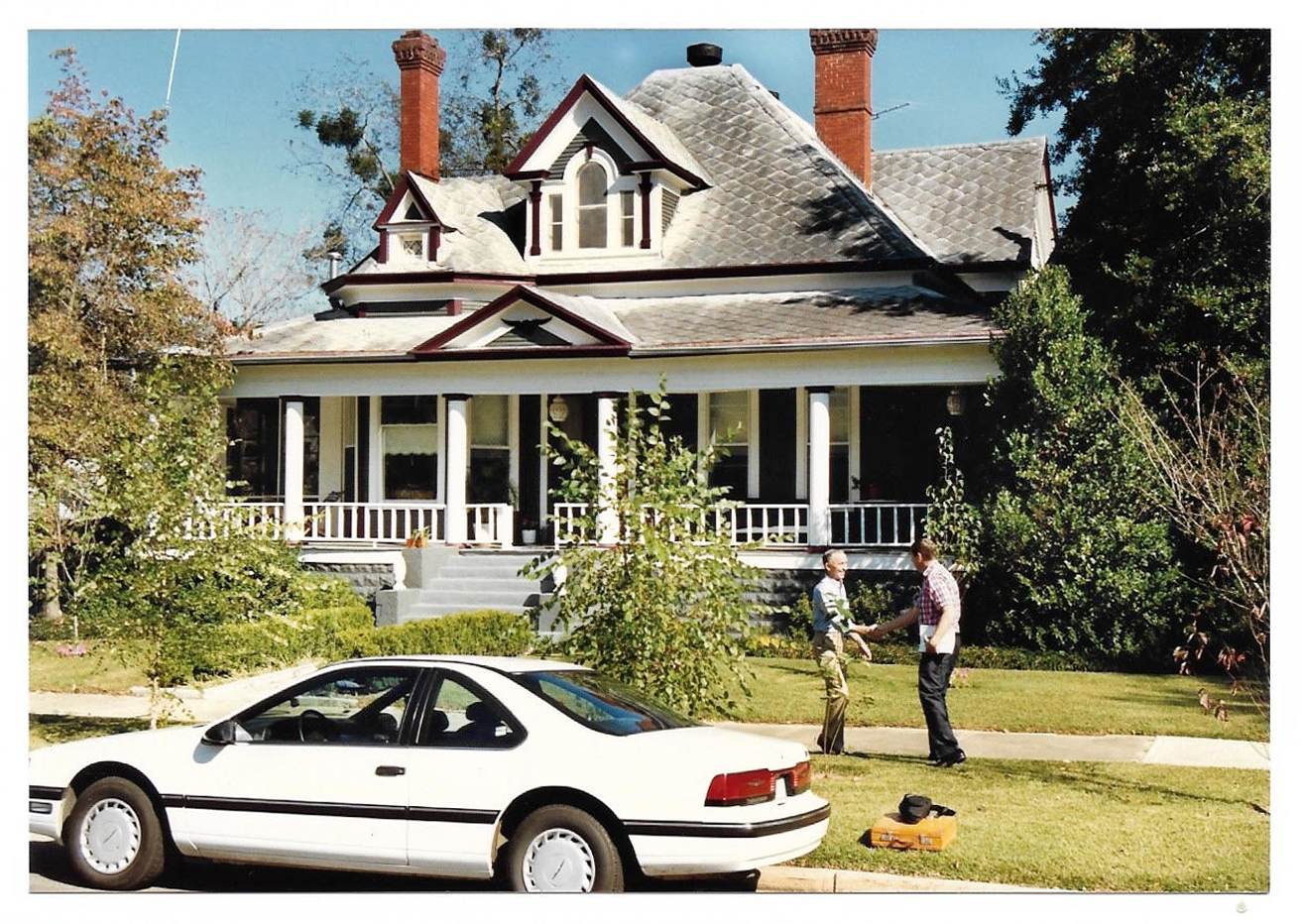

In 1982 Bill and Ellen Williams moved to a small town in Georgia.

Bill had always been involved in the markets but at this time he decided to be

dedicated to trading commodities full time and restoring an eighty year old house.

His regular successful trades led to his broker to spreading the word in Chicago.

The current count on Bitcoin is showing that we have finished the corrective wave marked as 5/C on the chart. Looking at the behavior since

We are checking back on the Bitcoin EW count with the PROFITUNITY approach. There was a complete 3rd wave move ending in mid April. We started

There was a completed 5 wave impulse wave up on February 25th, with divergence present on the Daily chart and AO. The market then quickly

On this Daily AUS/USD Forex chart we were counting the Corrective wave. Last week entry we labeled the waves with an A,B, and were looking

We are looking at Gold on the Daily chart to see where this market is in the Elliott Wave pattern. First, we examine the tallest

Bitcoin is quite a hot topic, even if you are not a trader! The purpose of this video blog is to show how PROFITUNITY Trading

No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed within this site, support and texts. Our course(s), products and services should be used as learning aids. If you decide to invest real money, all trading decisions are your own. Our track record is from trades given to subscribers in advance and are not hindsight. The results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Simulated trading programs are subject to the fact that they are designed with the benefit of hindsight. The risk of loss in trading commodities can be substantial. You should therefore carefully consider whether such trading is suitable for you in light of your financial condition.

Cftc rule 4.41 – hypothetical or simulated performance results have certain limitations. Unlike an actual performance record, simulated results do not represent actual trading. Also, since the trades have not been executed, the results may have under-or-over compensated for the impact, if any, of certain market factors, such as lack of liquidity. Simulated trading programs in general are also subject to the fact that they are designed with the benefit of hindsight. No representation is being made that any account will or is likely to achieve profit or losses similar to those shown.

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.